The Competitive Advantage: Adding Shipping Protection to Your Checkout Process

Shipped

on

June 12, 2023

Customer satisfaction and loyalty are paramount in ecommerce, where every business strives to gain a competitive edge. While aspects such as product quality, pricing, and customer service play significant roles, shipping protection is one often overlooked aspect that can make a difference. Incorporating shipping protection into your checkout process can provide a significant advantage to both businesses and consumers alike.

The Role of Shipping Protection in Ecommerce

Why Shipping Protection is a Competitive Advantage

Shipping protection serves as a valuable competitive advantage for e-commerce businesses. Retailers can set themselves apart from the competition by providing customers with trust, assurance, superior customer service, and a strong brand reputation. This strategic investment can help build customer loyalty and attract a larger customer base. The most significant aspects of shipping protection that offer ecommerce businesses a competitive edge include the following:

- Enhanced Customer Satisfaction: Ecommerce businesses that offer shipping protection demonstrate their commitment to customer satisfaction. By protecting customers against potential shipping risks, businesses show that they value their customers’ trust and investment. This leads to increased customer loyalty and positive word-of-mouth, ultimately driving repeat business.

- Prevent Chargebacks and Disputes: Offering shipping protection effectively prevents eventual chargebacks and customer disputes. By covering the cost of lost or damaged merchandise, businesses can protect their revenues from costly losses due to fraudulent claims.

- Differentiation from Competitors: In a highly competitive ecommerce landscape, standing out from the crowd is vital. Adding shipping protection to the checkout process sets businesses apart by providing an extra layer of service and security. Customers are more likely to choose a business that offers protection for their purchases, giving businesses a competitive advantage.

- Reduced Customer Service Burden: Businesses often face many customer inquiries and complaints regarding lost or damaged packages without shipping protection. By incorporating shipping protection, businesses alleviate this burden by proactively addressing potential issues. This frees up customer service resources, allowing businesses to focus on delivering exceptional customer experiences.

Incorporating Shipping Protection in the Checkout Process

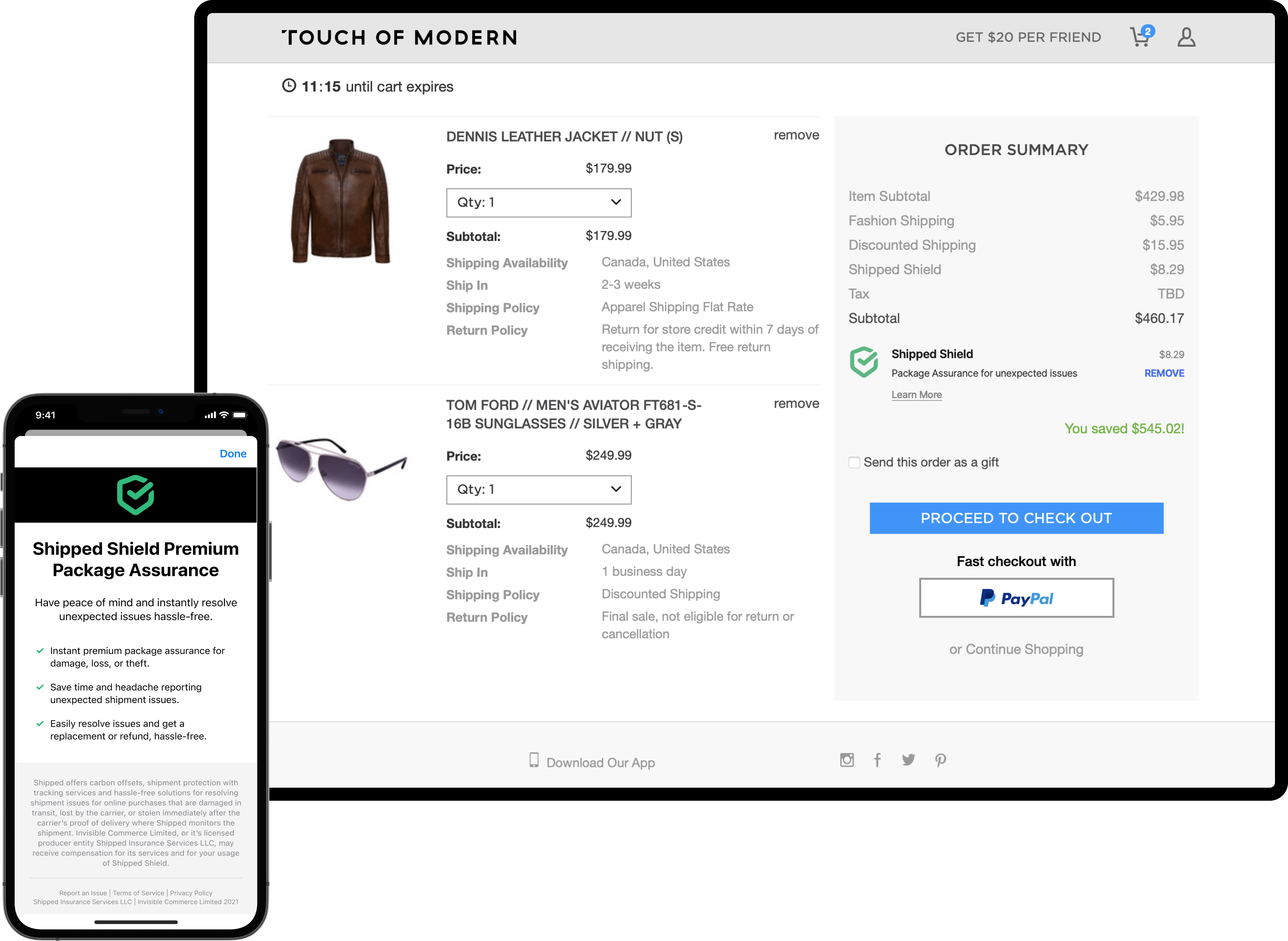

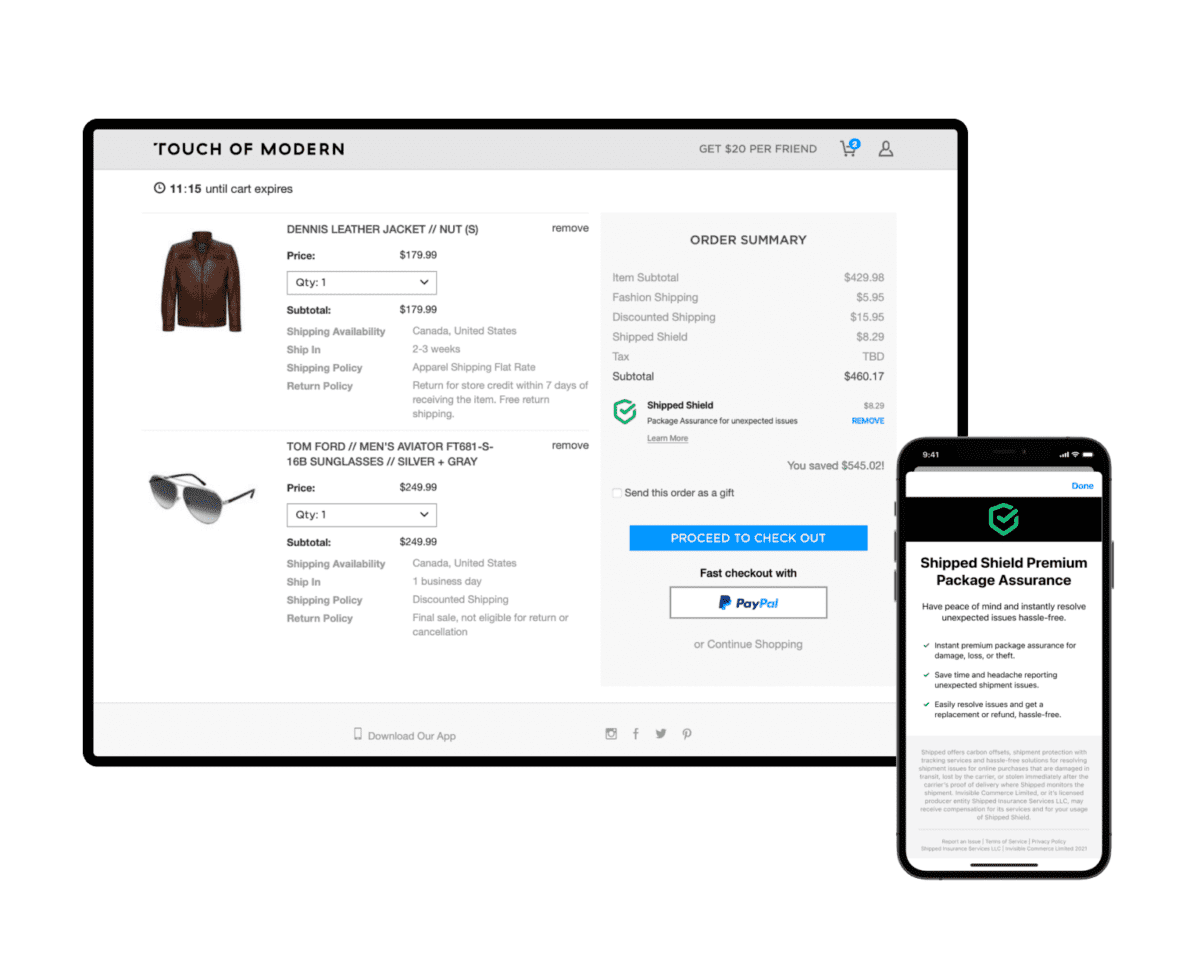

To incorporate shipping protection seamlessly into the checkout process, businesses can collaborate with third-party insurance providers specializing in shipping coverage. These providers offer tailored solutions that integrate with the ecommerce platform, allowing customers to easily add shipping protection to their order during checkout.

Transparent and clear communication about the protection options, terms, and coverage limits is essential to ensure customers fully understand the benefits and make informed decisions. The checkout process is the optimal place to offer shipping protection for several reasons:

- Seamless Integration: By integrating shipping protection into the checkout process, businesses streamline the customer experience. Customers can conveniently add coverage to their orders with just a few clicks without navigating to separate pages or contacting customer support.

- Transparent Pricing: Including shipping protection options during checkout ensures that customers are fully aware of the costs and coverage before finalizing their purchase. Transparent pricing builds trust and eliminates any surprises, fostering a positive shopping experience.

- Customization and Flexibility: The checkout process allows businesses to offer different levels of shipping protection based on the order value or customer preferences. This customization empowers customers to choose the level of coverage that suits their needs, further enhancing customer satisfaction.

How to Add Shipping Protection to Your Checkout Process

To add shipping protection to your checkout process, follow these steps:

- Identify a Trusted Shipping Protection Provider: Research and select a reputable shipping protection provider that aligns with your business’s needs and budget. Ensure they offer comprehensive coverage, easy integration, and excellent customer support.

- Configure Shipping Protection Options: Work with your shipping protection provider to configure the coverage options you want to offer during checkout. Consider factors such as coverage limits, deductibles, and pricing structures that best suit your customers and business requirements.

- Integrate the Shipping Protection Solution: Utilize the tools and resources provided by your shipping protection provider to integrate the solution into your ecommerce platform. This integration may involve adding code snippets or using plugins or extensions specific to your platform.

- Test and Optimize: Perform thorough testing to ensure the shipping protection feature functions seamlessly with your checkout process. Optimize the user interface and messaging to clearly communicate the benefits and terms of shipping protection to customers.

Overcoming Obstacles: Addressing Common Concerns about Shipping Protection

To enhance customer trust, addressing any common concerns or objections they may have regarding shipping protection is important. This can be achieved through clear communication during the checkout process. By explaining the benefits and terms of shipping protection in concise and easy-to-understand language, you can answer customers’ queries about coverage, claim processes, or additional costs.

Share positive experiences and testimonials from other customers who have benefited from shipping protection. Social proof can help alleviate doubts and build confidence in your protection.

The competitive advantage of shipping protection lies in providing assurance, convenience, and peace of mind for your customers. By building confidence and trust with them throughout their buying journey, you can create stronger customer relationships, foster loyalty and increase sales.

Including features such as automated claims processing or a money-back guarantee on lost packages are great ways to offer a superior customer experience. This can help you stand out from the competition and create an edge in your industry that will drive more sales and trust within your target audience.

Future Trends: Shipping Protection and the Evolution of Ecommerce

Looking ahead, several trends in ecommerce are likely to impact shipping protection and the checkout process:

- Automation and AI: Advancements in automation and artificial intelligence may allow for more accurate risk assessment during shipping and expedite the claims process, further enhancing the shipping protection experience.

- Personalized Coverage: As ecommerce continues to evolve, businesses may offer personalized coverage options tailored to individual customer profiles. This level of customization can increase customer satisfaction and improve the overall shopping experience.

- Data-Driven Insights: Data from shipping protection claims will provide invaluable insights into customer behavior, enabling businesses to optimize the checkout process. Incorporating a shipping protection solution into your checkout process can give you a competitive edge in the ecommerce space.

- Flexible Delivery Options: With flexible delivery options, businesses can provide customers with the convenience of having their orders delivered on their own schedule. This further enhances the customer experience and encourages loyalty.

Adding shipping protection to your checkout process is a strategic move that can provide your ecommerce business with a competitive edge. By protecting customers’ purchases and enhancing their satisfaction, businesses build trust, differentiate themselves from competitors, and reduce customer service burdens. Incorporating shipping protection seamlessly into the checkout process ensures a seamless shopping experience and fosters long-term customer loyalty.

Share your thoughts, experiences, and questions in the comments section below and join the discussion on the importance of shipping protection in the checkout process.