In the e-commerce sector, shipping insurance has emerged as a critical component of customer expectations. As businesses face the risks of damaged, lost, or stolen packages, understanding the nuances of shipping insurance becomes necessary. This guide will delve into the concept of shipping insurance, its importance, how to opt for it, and common misconceptions about it.

What is Shipping Insurance?

Shipping insurance, sometimes called parcel insurance, is the process by which premiums are paid to a third party, the insurer, in exchange for that party assuming the risk or liability associated with a shipment. The insurance covers the item from when it leaves the merchant’s warehouse until it reaches the customer, and they express satisfaction with the product.

Why Do You Need Shipping Insurance?

Shipping insurance becomes critical in protecting the merchant and the customer from various shipping-related risks. According to Reuters, over half of the customers expect quick reshipment of damaged items, indicating the high expectations set on merchants to ensure the safe delivery of their products. Without shipping insurance, e-commerce businesses can sustain significant financial losses.

Moreover, insurance also covers ‘gap areas’ that might not fall under the responsibility of the shipping carriers, such as porch theft. It’s important to remember that while carriers offer some insurance, more is needed, and additional coverage is typically required. For example, UPS shipping insurance only covers $100 without extra payment, regardless of the declared value of the package, and they do not cover theft after a package has been delivered.

How to legally utilize Shipping Insurance?

Shipping insurance can be included on a commercial inland marine insurance policy that protects the entire shipping process. Insurance agents or brokers make shipping insurance coverage available to merchants, collect the premium, and send that premium to licensed insurers. However, it’s important to note that insurance agents or brokers must carry a license in every state they sell shipping insurance. Unauthorized selling of insurance can lead to severe penalties.

Understanding the Cost

The cost of shipping insurance, or the insurance fee, is the premium paid to the insurer for assuming the risk. For example, UPS includes the first $100 of declared value in their shipping insurance but charges an additional $3.45 for every amount between $100 and $300. After $300, the cost increases by $0.15 per $1,000 value. Similarly, FedEx covers the first $100 declared and requires additional fees based on the parcel’s value.

Common Shipping Insurance Misconceptions

One common misconception about shipping insurance is that declaring a value during the shipping process automatically provides coverage. Declaring a value does not guarantee reimbursement or the amount declared. Carriers require merchants to submit a written claim, and they investigate each case accordingly. If the packaging was done improperly and the package gets damaged during shipping, most carriers will not be held responsible.

It’s essential to clear up any misconceptions about shipping insurance that may influence your decision-making process or expectations. Here are a few common myths and the truths behind them:

Myth: Declaring a value automatically provides full coverage.

Fact: Declaring a value does not guarantee reimbursement or the amount declared. Major carriers require merchants to submit a written claim, and each case will be investigated accordingly. Investigations typically look at the packaging chosen and how the shipment was packed. If the package were damaged during shipping due to improper packaging, most carriers would not be held responsible.

Myth: Shipping insurance is optional because the carrier provides it.

Fact: Shipping insurance from major carriers, such as UPS and FedEx, often needs to be increased. They typically only cover up to $100 without additional payment, regardless of the declared value. Plus, they can make filing a claim difficult and getting an approved reimbursement. There are often complicated forms, long waiting periods, and vague terms on what is covered and what needs to be clarified. Carriers are also not liable for “porch piracy” or theft after a package has been delivered.

Myth: Shipping insurance only benefits the merchant.

Fact: Shipping insurance protects both shippers and receivers against damaged, lost, or stolen packages. It turns lost or damaged packages into a minor inconvenience for customers and merchants alike. Quick, easy, automated claims processing also leads to happier customers.

Myth: All shipping insurance providers are the same.

Fact: Not all shipping insurance providers offer the same level of service. For example, platforms like Shipped Suite provide an easy-to-use, integrated solution for shipping protection, tracking, and even carbon credits. They automate the customer experience around the entire post-sale process, streamlining operations to reduce costs and boost store profitability.

Shipping insurance is a vital aspect of e-commerce, providing a safety net for merchants and customers against the unpredictable risks associated with shipping. Although there are costs associated with shipping insurance, the potential losses from not having it are often much greater. As the e-commerce industry grows, so does the importance of understanding and utilizing shipping insurance for merchants looking# The assistant’s message was cut off. I’ll continue it now.

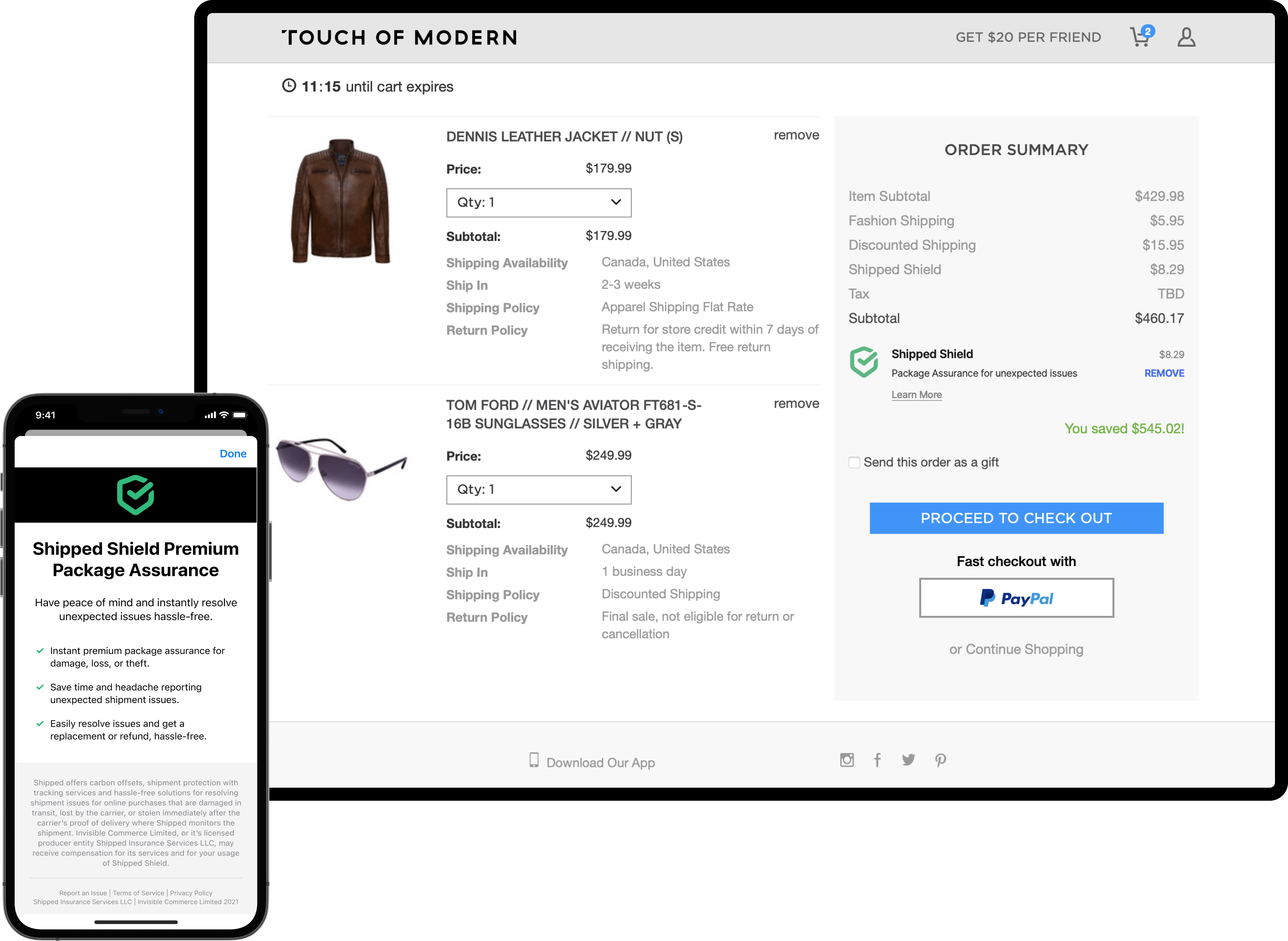

Why Shipped Suite is the best solution for package assurance for shipping insurance coverage.

- We automate customer service around the entire post-sale experience, not just package protection.

- Shipped Shield covers headaches from carrier damage, loss, and theft.

- Shipped Insurance Services LLC, a wholly-owned subsidiary, is our legally licensed insurance agency.

- We provide an easy-to-use, integrated shipping protection, tracking, and carbon credits solution.